mississippi state income tax brackets

Tax Bracket Tax Rate. Eliminate the states 4 tax bracket on peoples first 5000 of taxable income starting 2023.

States With Highest And Lowest Sales Tax Rates

4 5000.

. 3 on the next 3000 of taxable income. 5 10000 Source. If you are receiving a refund PO.

Tax Years 2020 2021 and 2022. The tax brackets are the same for all filing statuses. Mississippi State Married Filing Jointly Filer Tax Rates Thresholds and Settings.

Discover Helpful Information and Resources on Taxes From AARP. The state has a 4 tax on the next 5000 of income and a 5 tax on all income above that. Married filers do not pay taxes on first 36600 of income.

All other income tax returns P. These income tax brackets and rates apply to Mississippi taxable income earned January 1 2020 through December 31 2020. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

4 5000. Mississippi has some of the most generous exemptions for retirement income of any US. Additionally the state has property taxes that rank among the lowest in the country.

Tax Rate Single Married. 4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. Tax Bracket Tax Rate.

Mississippi State Single Filer Tax Rates Thresholds and Settings. In addition check out your federal tax rate. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

Mississippi also has a 400 to 500 percent corporate income tax rate. Any income over 10000 would be taxes at the highest rate of 5. Eliminates the 4 tax bracket by 2023.

Box 23058 Jackson MS 39225-3058. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. 0 on the first 2000 of taxable income.

The 5 tax on remaining income will drop to 47 for 2023 then 44 for 2025 and 4 starting in 2026. Because of tax cuts approved years ago the tax-free amount will increase to 13300 after this year. 3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year.

Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax. To provide that it. Mississippis Individual Income Tax Rate Schedules.

5 10000. Single income taxpayers do not pay taxes on first 18300 of income. Mississippi based on relative income and earningsMississippi state income taxes are listed below.

3 4000. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. The graduated income tax rate is.

Mississippis 3 Percent Income Tax Rate Will Phase Out by 2022. Another 10 have a flat tax rateeveryone pays the same percentage regardless of how much they earn. 3 3000.

There is no tax schedule for Mississippi income taxes. Income tax brackets are required state taxes in. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022.

Income sources that are exempt from state taxes include Social Security retirement benefits pensions 401ks and IRAs. The Mississippi Single filing status tax brackets are shown in the table below. 4 on the next 5000 of taxable income.

Ad Compare Your 2022 Tax Bracket vs. Highlights of the income tax cut compromise plan. Mississippi State Personal Income Tax Rates and Thresholds in 2022.

Box 23050 Jackson MS 39225-3050. Mississippi State Single Filer Personal Income Tax Rates and Thresholds in 2022. 4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax.

19 hours agoEach resident of the Natural State paid an average of 4282 in taxes in 2019 while the average per-capita state tax burden of Arkansas neighboring states is 4147. Your 2021 Tax Bracket to See Whats Been Adjusted. Mississippi Income Taxes.

Tax Year 2020 Tax Year 2021 Tax Year 2022. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Overall state tax rates range from 0 to more than 13 as of 2021.

5 bracket cut to 47 by 2024 44 by 2025 and 40 by 2026. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippis sales tax rates are close to.

To amend section 27-7-5 mississippi code of 1972 to reduce the state income tax on the taxable income of individuals. Join our member community today to help us reach our goal of welcoming 100 new members. This means that residents of.

4000 - 50004000 - 50004. Provides tax relief of 525 million per year by 2026. Pennsylvania Income Tax Brackets 2020.

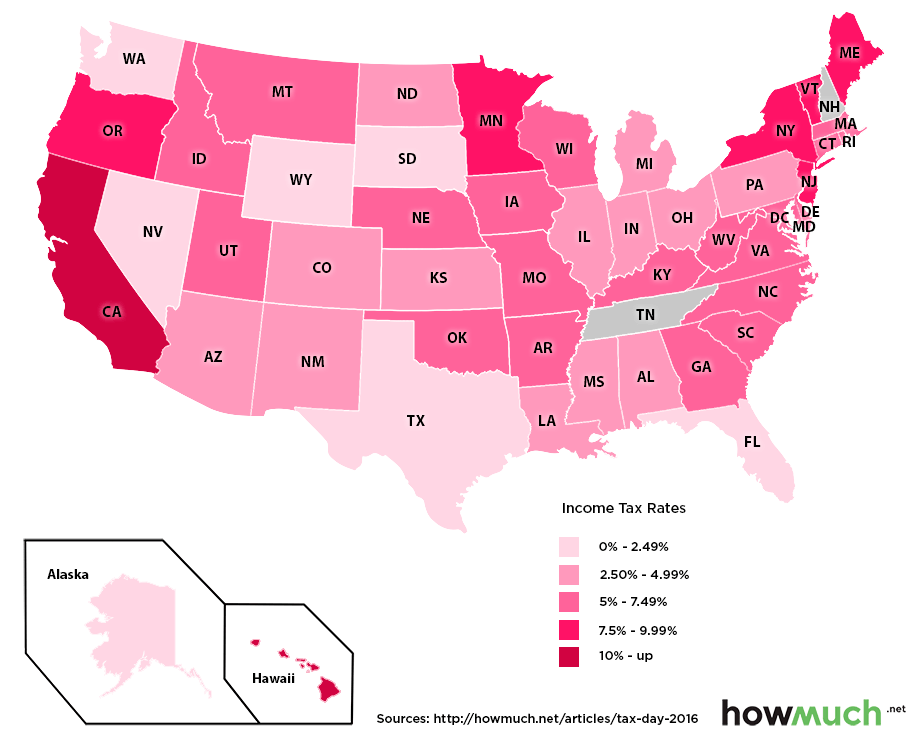

Mississippi - Married Filing Jointly. An act to create the mississippi tax freedom act of 2022. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in the country and eight states have no tax on earned income at all.

5 on all taxable income over 10000.

Tax Rates Exemptions Deductions Dor

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Mississippi Tax Rate H R Block

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Which U S States Have The Lowest Income Taxes

The Most And Least Tax Friendly Us States

How Do State And Local Individual Income Taxes Work Tax Policy Center

Mississippi Income Tax Calculator Smartasset

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Where S My Mississippi State Tax Refund Taxact Blog

Mississippi Sales Tax Small Business Guide Truic

Qod How Many States Do Not Have State Income Taxes Blog

Tax Rates Exemptions Deductions Dor

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation