property tax las vegas nv

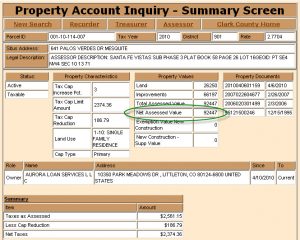

Las Vegas NV 89106. 200000 taxable value x 35.

Las Vegas Area Clark County Nevada Property Tax Information

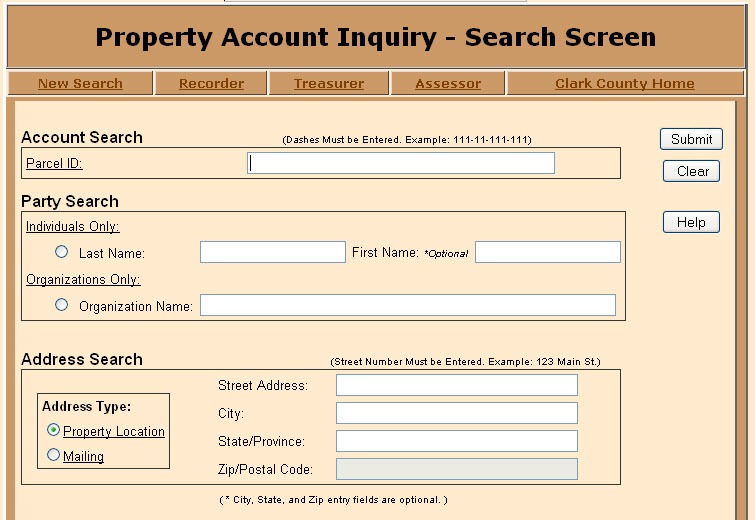

A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada.

. Public Property Records provide information on land homes and commercial. As highly respected unbiased third-party specialists in property tax consulting management valuations and. Click here to pay real property taxes.

Las Vegas NV 89155-1220. LAS VEGAS KTNV You could be paying more on your property tax than you realize. Road Document Listing Inquiry.

Tax amount varies by county. A composite rate will produce expected total tax receipts and also. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

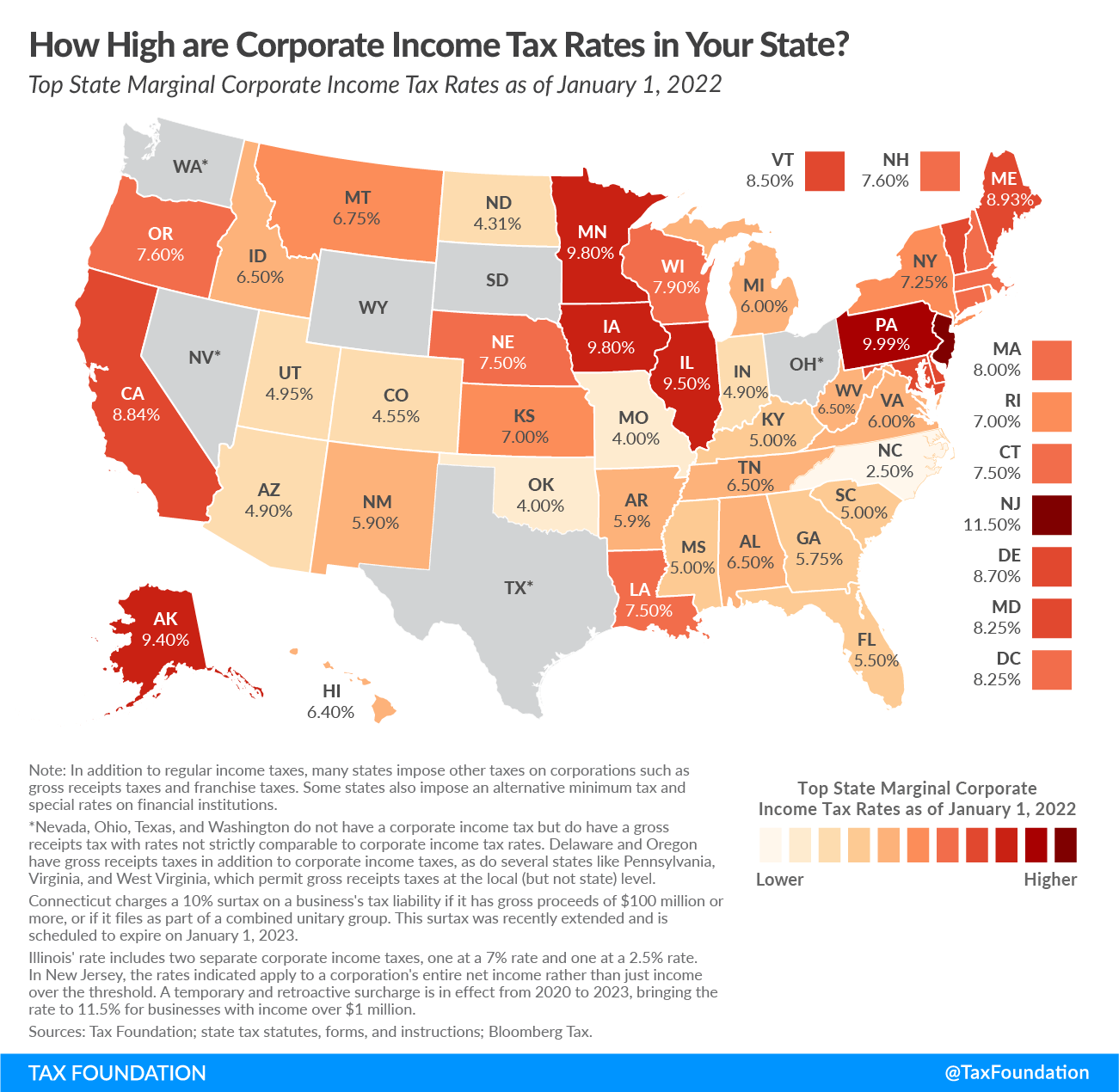

Las Vegas NV currently has 3973 tax liens available as of October 10. You must have either an 11-digit. However the property tax rates in Nevada are some of the lowest in the US.

Las VegasProperty Tax Services. Checks for real property tax. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues.

What is the Property Tax Rate for Las Vegas Nevada. In Las Vegas NV estimated annual. 10332 Frostburg Ln Las Vegas NV 89134 375000 MLS 2421593 Welcome to maintenance free Sun City Summerlin single story.

2 beds 2 baths 1332 sq. To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date.

The states average effective. CALCULATING LAS VEGAS PROPERTY TAXES. Property Tax Cap Video.

Property taxes in Nevada pay for local services such as roads schools and police. Nevada is ranked number twenty four out of the fifty. Tax District 200.

Payments can be made by calling our automated information system at 702 455-4323 and selecting option 1. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Homeowners in Las Vegas NV Benefit from Low Property Tax Rates In Nevada property taxes are among the lowest in the country.

500 S Grand Central Pkwy 1st Floor. The median property tax in Nevada is 084 of a propertys assesed fair market value as property tax per year. Determine the assessed value by multiplying the taxable value by the assessment ratio.

Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. With market values established Las Vegas along with other in-county public districts will calculate tax levies alone. Tax Rate 32782 per hundred dollars.

In Nevada the market value of. 500 S Grand Central Pkwy. Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada.

Office of the County Treasurer. Under state law as a property owner you can apply for a three percent tax cap on your.

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Nevada Homeowners May Be Paying More On Property Taxes

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

10 Best Property Tax Lenders In Las Vegas Nv Quick Online Application Las Vegas Property Tax Loans Near Me

Mesquitegroup Com Nevada Property Tax

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Nevada Property Owners Face Deadline To Avoid Paying Higher Property Taxes Dr Daliah

Nevada Property Tax Bills Very Vintage Vegas Las Vegas Mid Century Modern Homes

720 E Charleston Blvd Las Vegas Nv 89104 Property Record Loopnet Com

Nevada Ranked At 9 For Lowest Property Taxes Las Vegas Review Journal

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Tax Settlements Resolved In Nevada 20 20 Tax Resolution

Fill Out This Form Save Money On Property Taxes Boulder City Home Of Hoover Dam Lake Mead

Fillable Online Clarkcountynv On Line Fillable Forms Clark County Nevada Fax Email Print Pdffiller

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

Nevada Property Tax Calculator Smartasset

Clark County Property Tax Hike Confusion And Frustration Persist Las Vegas Review Journal